2020 was a great year for AI in drug development where the total investment in the industry hit $9.2B and many partnerships between AI specialists and the pharmaceutical industry were formed. 2021 may prove to be just as exciting, as this year’s first acquisition was already confirmed when Charles River Laboratories announced the acquisition of Distributed Bio for $83M plus $21M in performance payments. But what happens to the AI ecosystem when a major CRO acquires an AI specialist, as opposed to the traditional big pharma acquirers? In this article, we will take a closer look at the acquisition in the context of the AI ecosystem and value chain and discuss what developments we can expect in the coming years.

How the AI Drug Development Vendors are Organised

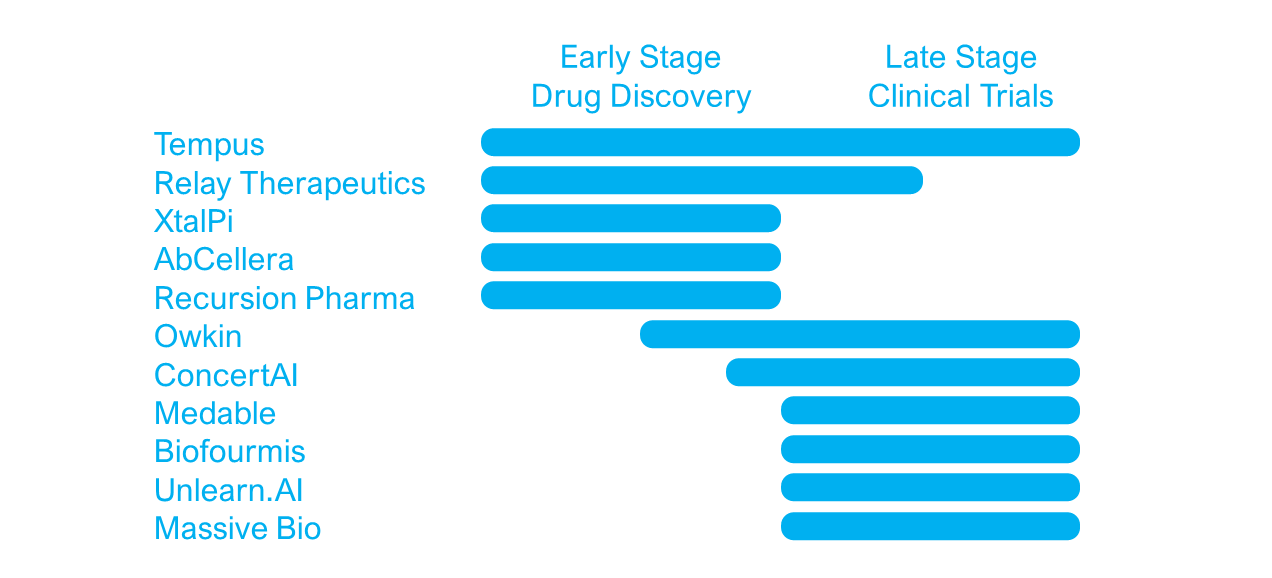

The 250 AI specialists in the drug development industry are distributed across drug development stages from early drug discovery to late clinical trial optimisation. Most vendors have a very specific therapeutic focus in a defined stage of the development process, whereas others build platforms serving across development stages and therapeutic areas.

Early stage drug design vendors use AI applications to develop new molecules, predict and optimise drug specificity and efficacy or select drug repurposing options for existing drugs. Vendors focusing on late stage development use AI applications to optimise the clinical trial process by improving patient stratification, optimise enrolment and retention, and help reduce the number of patients needed for a successful trial.

Working across the entire drug development process but often used in clinical trials, are artificial intelligence platforms called information engines. These AI platforms aggregate and analyse information and real-world evidence from multiple sources such as scientific literature, patient data and clinical trial information to find new associations and guide drug discovery or clinical trial optimisation.

The Current Pharma-AI Partnership Model

Business models vary greatly across the industry, but generally fall into distinct categories depending on the type of application being offered. Particularly for drug discovery and drug design AI applications, revenues are split between an initial payment upon signing the agreement and performance dependent milestone payments as the projects progress. These milestone payments are often several times larger than the initial payments.

For most AI specialists, this gives revenue to help cover some of the operational costs to look more favourable in the eyes of future investors, and it gives promises of rapid financial growth once projects complete successfully. For the pharma partner, the partnership model reduces the risk associated with drug development and forms the foundation for tighter relationships with successful AI specialists.

The Emerging Role of CROs in the AI Ecosystem

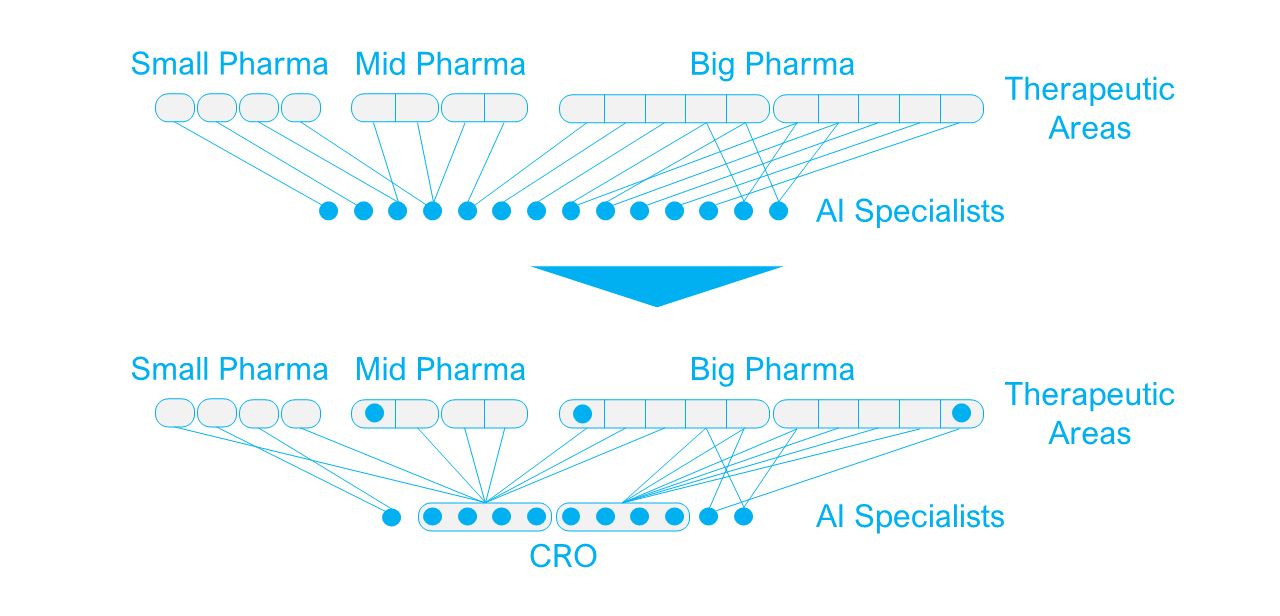

Until now, drug discovery AI startups have mainly earned their revenue from partnerships with pharma companies. But while CROs have been acting merely as a bridge between startups and the pharma sponsor in clinical trials until now, some CROs are now looking at AI startups as components that could add considerable value to their offering.

While most traditional CRO capabilities are shifted towards late development stages and clinical trials, an increasing number of CROs are now specialising in drug discovery services, either as a sole focus, or with an ambition to offer end-to-end services to the pharmaceutical industry. For these CROs the AI drug discovery startups are particularly interesting because:

- They support their reputation as progressive drug discovery partners with capabilities beyond traditional pharma companies.

- They can use their capabilities across different projects with multiple pharma partners and therefore add significant value.

- The CRO acquires AI competencies which can create synergy with other business units within the CRO.

- It strengthens the overall end-to-end offering to create tighter partnerships with pharma companies.

For the startup being acquired by a CRO, it can be an attractive exit strategy too. They can continue their existing partnerships with pharma companies, and will remain in a similar consultative role serving the pharma industry as a whole, as opposed to being restricted by the pipeline limitations of a pharma acquirer. They will keep the potential to add value to projects across the industry and benefit from the CRO’s established pharma partnerships.

How Will the Pharma Industry React?

For the pharmaceutical industry, this development is no surprise and actually plays well with their long-term strategy of reducing cost and risk in their R&D programmes, while remaining competitive. The current milestone partnership model is exactly what the pharma industry needs to increase profitability in their R&D programmes, since only successful projects impose notable expenses. So, for a pharmaceutical company, an AI specialist being acquired by a CRO, is an AI specialist not being acquired by a competitor, and therefore a company who can remain a long-term partner.

However, looking ahead, we will start to see pharma companies acquiring AI partners that are essential to their main therapeutic areas. These acquisitions will be motivated by a wish to strengthen internal R&D capabilities to secure future competitiveness in a more cost-effective way, but also to prevent an essential partner being acquired by a competitor. The acquirer will be aware these acquisitions introduce risk and costs they would have preferred to be without, and they will therefore hold until the technologies have proven their worth on ongoing projects, and they could risk losing the AI partner to a competitor.

Over the next three to five years, milestone payments to AI partners will increase significantly as projects come to completion. In the meantime, pharma companies are focusing on developing their AI infrastructure and creating a framework which maximises the value of their AI efforts. This means, they are currently engaged in hefty digital transformations to open up siloed data and building compatibility across functions and businesses. They thereby create large quantum computing-ready data lakes, that can serve as a foundation for AI enabled drug development as well as business process optimisations. For an AI specialist to add significant value to a pharma company through acquisition, it will need to become an integrated component in these efforts.

More Research Available

Emersion Insights specialise in strategic market intelligence for investors and entrepreneurs. Our market report “AI in Drug Development” includes detailed investment analysis, market sizing, forecasting and strategic insights to help entrepreneurs navigate in this fast-moving industry. Reach out to Founder & Principal Analyst Dr Ulrik Kristensen for more information: hello@emersioninsights.io