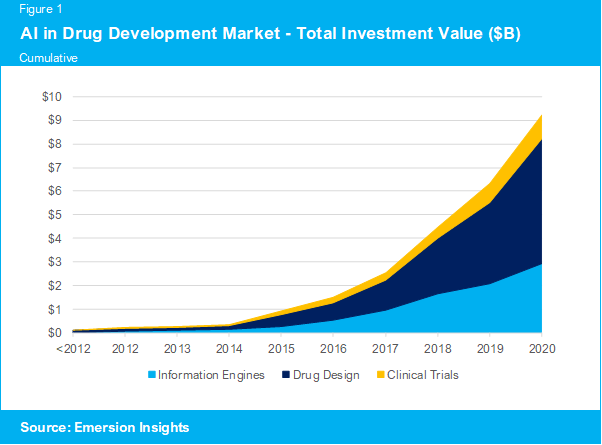

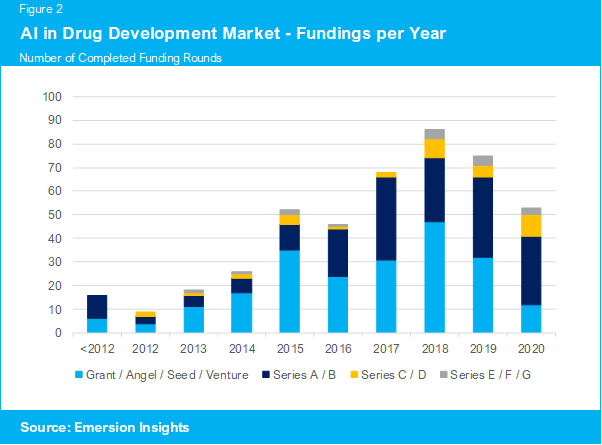

The market for AI in Drug Development had a record year in 2020 with $2.9B new funding and a total funding in the industry reaching $9.2B. But while the annual investment value is reaching new heights, the number of completed funding rounds has continued its downfall. Emersion Insights has analysed the investment landscape and categorised the industry into Information Engines, Drug Design and Clinical Trials.

Most Funded Vendors in 2020

Information Engines are artificial intelligence platforms that aggregate and analyse information and real-world evidence from multiple sources such as scientific literature, patient data and clinical trial information to find new associations and guide drug discovery or clinical trial optimisation. In this category, Tempus, ConcertAI, Nference, DNAnexus and Owkin received most funding in 2020.

Drug Design applications are using AI to develop new molecules, predict and optimise drug specificity and efficacy or select drug repurposing options for existing drugs. Drug Design companies received more than 60% of the total investments in 2020, with XtalPi, AbCellera, Recursion, Erasca and Insitro being the most funded companies in this category in 2020.

Clinical Trial applications help optimise the clinical trial process by improving patient stratification with finer nuances to get the right patients for the right trials, optimise enrolment and retention, and in some cases help reduce the number of patients needed for a successful trial. In this category, Medable, Biofourmis, Unlearn.AI, Inato and Novadiscovery received most funding in 2020.

Increasing Consolidation, But Still Opportunities for Innovative New Entrants

Although the investment amount increased significantly in 2020, the number of deals per year has decreased since 2018. The funding rounds are getting bigger but fewer, and the investments are often going to a few established major players.

Actually, the most funded vendors Tempus, Relay Therapeutics, Genuity Science, Recursion Pharmaceuticals and XtalPi have altogether received 28% of the total investment in the industry.

But although the industry is seeing increased consolidation, there are still opportunities for innovative new entrants. Some of the companies that received seed funding in 2020 include Dyno Therapeutics and Menten AI using machine learning to develop new drug designs, and Phenomic AI and Massive Bio with their information engines for oncology drug discovery and clinical trial matching.

More Research Available

Emersion Insights specialise in strategic market intelligence for investors and entrepreneurs. Our market report “AI in Drug Development” includes detailed investment analysis, market sizing, forecasting and strategic insights to help entrepreneurs navigate in this fast-moving industry. Reach out to Founder & Principal Analyst Dr Ulrik Kristensen for more information: hello@emersioninsights.io