The market for artificial intelligence in drug development and discovery has been one of the most hyped in recent years. The potential impact this industry can offer to human health and pharmaceutical development has grown in concert with the enabling technologies in computer processing, digitalisation and fundamental research in machine learning.

Emersion Insights has analysed the investment landscape as part of our market intelligence service for AI in Drug Development. In this article, we take you through the progress the industry has made in the first half of 2021.

What Has Happened in the Industry This Year?

As the confidence in AI for drug development grows, new partnerships between AI specialists and pharmaceutical companies are announced daily. This year has already offered major headlines about new collaborations and milestones from existing partnerships. Here is a selection of main developments during the first half of 2021:

- AbCellera and Gilead Sciences announced a new multi-target antibody discovery collaboration building on their previous infectious disease partnership from 2019. The Vancouver based AI firm is now starting to reap the fruits of their labour, as successful antibody discovery programs already earned the company $203 million in revenue in Q1 this year, including $178 million in milestones and royalties.

- Gilead Sciences also announced a very interesting partnership during the first half of 2021, this time with Gritstone Oncology to create a vaccine-based immunotherapy as a cure for HIV. Under the terms of the deal, Gilead is paying Gritstone $30 million up front and a $30 million equity investment, and potentially an additional $725 million in regulatory and commercial milestones and royalties on net sales.

- BenevolentAI and AstraZeneca have been collaborating closely since 2019 to use AI and machine learning for the discovery and development of new treatments for chronic kidney disease (CKD) and idiopathic pulmonary fibrosis (IPF). In January this year, AstraZeneca then announced it has selected a novel chronic kidney disease (CKD) target to advance to its drug development portfolio, making it the first AI-generated target from the collaboration to enter the company’s portfolio.

- Another major announcement this year came from Exscientia who initiated a multi-target, AI-driven drug discovery collaboration with Bristol Myers Squibb. The agreement included up to $50 million in upfront payments, up to $125 million in near to mid-term potential milestones, and additional clinical, regulatory and commercial payments that take the potential value of the deal beyond $1.2 billion.

- CytoReason, the Israeli company developing a computational model of the human body for faster drug discovery and development, announced a collaboration with Ferring Pharmaceuticals, which aims to establish new treatment options for patients with inflammatory bowel disease (IBD). CytoReason’s approach to speed up clinical and pre-clinical drug development programs is already in use by some of the largest pharmaceutical companies including Pfizer, Sanofi and Roche.

- Insilico Medicine discovered a novel preclinical candidate addressing idiopathic pulmonary fibrosis (IPF). Often found implicated in a wide range of diseases and multiple organs such as lung, liver and kidney, IPF addresses a broad medical need that affects hundreds of thousands of individuals worldwide.

Investors Remain Bullish in 2021

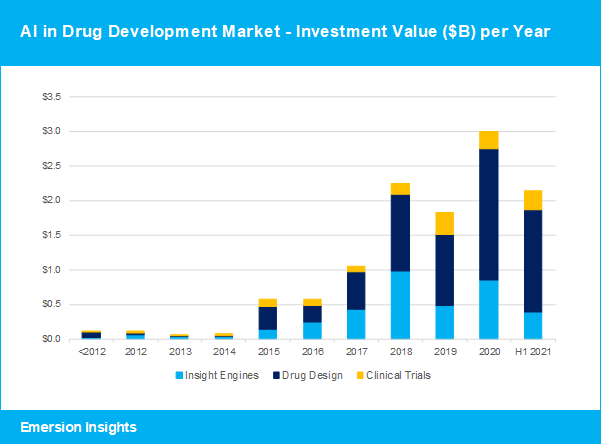

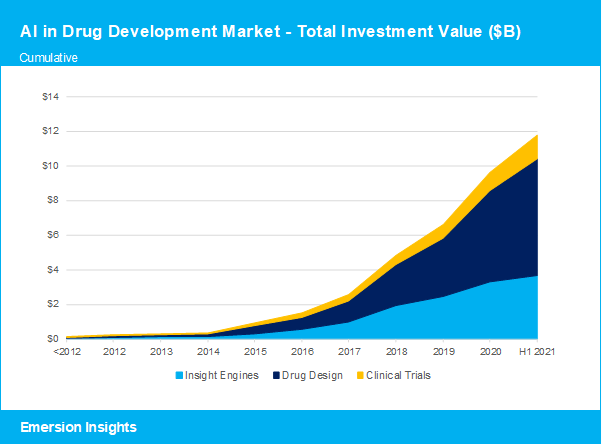

2020 was a fantastic year for funding in AI drug development. Although the number of funding rounds peaked in 2018 and has been decreasing since, the total annual investment value reached new heights in 2020. In fact, the average funding size has increased from $10.7 million in 2015 to $51.7 million in 2020. Investment rounds are becoming fewer, but bigger, and the high investment activity we saw last year has continued into the first half of 2021. During the first half of 2021, the investment value has already reached $2.1 billion, or 71% of last year’s total value.

Some of the major Series A and B fundings this year include:

- Cellarity ($123 million), Dyno Therapeutics ($100 million), Enveda Biosciences ($51 million), Engine Biosciences ($43 million), BigHat Biosciences ($19 million)

Series C and D funding rounds in the AI drug development industry are on average 3.48 times bigger than Series A and B funding rounds. Series C and D fundings therefore contribute significantly to the total investment value in the industry. Some of the most prominent Series C and D funding rounds in the first half of 2021 include:

- Insitro ($400 million), Insilico Medicine ($255 million) and Exscientia ($100 million). Exscientia’s Series C was followed by a Series D with an additional $225 million and access to further $300 million at their discretion.

With a total of $11.8 billion funding in the industry and $2.1 billion invested already this year, 2021 is well underway to become a landmark year for AI in drug development. Emersion Insights has categorised the investments according to company focus into Insight Engines, Drug Design and Clinical Trials.

Insight Engines are artificial intelligence platforms that aggregate and analyse information and real-world evidence from multiple sources such as scientific literature, patient data and clinical trial information to find new associations and guide drug discovery or clinical trial optimisation. Some of the Insight Engine vendors funded this year include Aetion, Cellarity, Causaly and Elucidata.

Drug Design applications are using AI to develop new molecules, predict and optimise drug specificity and efficacy or select drug repurposing options for existing drugs. Some of the Drug Design vendors funded this year include Insitro, Exscientia and Insilico Medicine.

Clinical Trial applications help optimise the clinical trial process by improving patient stratification with finer nuances to get the right patients for the right trials, optimise enrolment and retention, and in some cases help reduce the number of patients needed for a successful trial. Some of the Clinical Trial vendors funded this year include Medable, Mendel.ai and Novadiscovery.

What Can We Expect from the Rest of 2021?

This year already offered a glimpse of what’s coming next as significant strategic developments occurred in the first six months. IPO’s, acquisitions and technology partnerships between AI specialists were all represented.

Although only a few startups in this industry have gone public, IPO’s are occasionally announced. This year, Adagene closed its IPO raising $161 million in gross proceeds, and the Danish AI-immunology company Evaxion Biotech raised $30 million on its IPO on Nasdaq.

In the coming years, we will start to see the leading AI specialists acquire smaller players to strengthen their overall offering as part of a long-term CRO strategy. The intention is to become best-of-breed partners to the pharmaceutical industry in a specific area, and then gradually broaden their scope and capabilities to become preferred industry partners across multiple areas. At this point, only a few companies have the scale to go for this strategy, but we already see steps in this direction.

During the last 6 months, Exscientia acquired personalised medicine AI company Allcyte, and Relay Therapeutics acquired ZebiAI in a $85 million acquisition. Also, PrecisionLife announced that it had acquired its long-term technology development partner GenoKey, continuing its expansion as an AI-enabled precision medicine company.

A couple of development partnerships between AI specialists were also announced in the last six months. Cyclica established partnerships with PrecisionLife and South Korean Oncocross, and QIAGEN, in the AI world best known for their Ingenuity Pathway Analysis (IPA) and Digital Insights portfolio, formed a partnership with GNS Healthcare.

As the industry matures, we can expect to see more Series C, D and E funding rounds being announced in the next 6 months, likely making this year’s total investment value exceed last year’s record. Further development partnerships between AI specialists will be established, and some of the already existing partnerships will result in mergers and acquisitions as the consolidation in the industry continues. Acquisitions by big pharma will most likely remain relatively sparse in the short term, however, in the coming months, we may see further acquisitions by large drug discovery CRO’s and AI specialists going for a long-term CRO strategy.

More Research Available

Emersion Insights specialise in strategic market intelligence for investors and entrepreneurs. Our AI in Drug Development market report includes detailed investment analysis, market sizing, forecasting and strategic insights to help entrepreneurs navigate in this fast-moving industry. Reach out to Founder & Principal Analyst Dr Ulrik Kristensen for more information: hello@emersioninsights.io