As the world is facing threats of a major recession in the slipstream of the Covid-19 pandemic, the AI drug development industry is caught in a limbo with hesitating investors despite evident market growth. In this analyst insight, we explore the recent investment activity in AI drug development and discuss what start-ups can do to adapt to a scenario of slow growth and elevated inflation.

Stagflation Fear Affecting AI Drug Development Industry

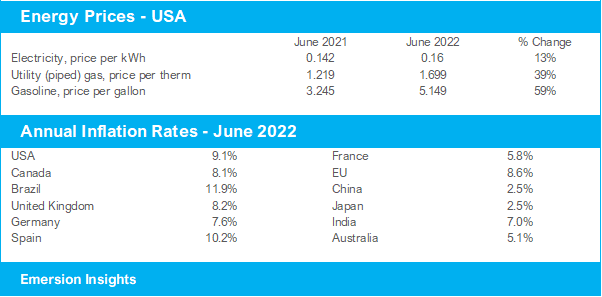

Financial markets have suffered in 2022. The compounding damage from the Covid-19 pandemic and the Russian invasion of Ukraine has magnified the slowdown in the global economy, which is entering what could become a protracted period of slow growth and elevated inflation. This raises the risk of stagflation, and for many countries, recession will be hard to avoid. Continued lockdowns in China, supply-chain disruptions and a surge in energy prices means company expenses are increasing across industries, and revenues are under pressure. Consequently, the S&P 500 stock market index for the largest companies in the US has lost 18% this year.

Just like many other industries, the AI drug development industry is also affected by the current situation. While the onset of the pandemic in 2020 provided opportunities as well as challenges, investors now fear that enemy number one for start-ups will hit hard: cash flow problems. And their concerns are valid.

Covid restrictions put many clinical trials on hold, prompted sponsors to suspend enrolment, pushed back initiation dates, and caused trials to terminate. Trials in toxicology and neurology were among the most frequently suspended, delayed, or prematurely concluded. In contrast, oncology trials were often able to continue operations without major disruption. Although most of the suspended trials have resumed enrolment, many continue to experience disruption. And this hits AI start-ups double hard. New deals have been harder to come by due to delayed trial initiations, and interruptions in ongoing trials have hindered milestone payments and royalties, which carry significant weight for these start-ups due to their proportionate size in the deal composition.

Increasing expenses and supply-chain disruptions are also making it more difficult for AI start-ups to do business. Fuel and electricity prices affect office and hardware running costs, however, compared to other industries the effect is modest. Although it already has improved a lot since the initial Covid lockdowns, vendors still report supply-chain disruptions and hardware blocked in transit due to Covid restrictions, putting extra delays on hardware purchases and client installations.

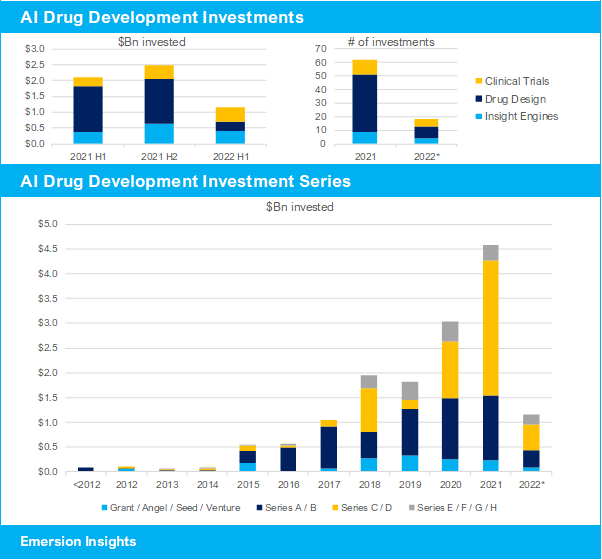

Consequently, investors have been reluctant to put more money in AI drug development during the first half of 2022. Funding has dropped from $2.5 billion in the second half of 2021 to only $1.2 billion in the first half of 2022. A total of 62 funding rounds were completed in 2021, but only 18 during the first half of 2022.

After the high investment activity we saw in 2021, where the total cumulative investment in AI drug development exceeded $13 billion, investors have undeniably been more reserved during the first half of 2022.

Despite Fear, Market Growth Still Evident

Despite stagnating investments during the first half of the year, there is still growth in the market. Although most companies in the AI drug development industry are still highly dependent on investors, many deals and partnerships with pharmaceutical companies are already established and revenue is generated.

Many investors fear the current macroeconomic situation will affect the pharmaceutical industry and limit their engagement in AI projects. However, apart from the limitations and delays already caused by interrupted clinical trials, the current situation is unlikely to negatively impact the long-term interest in AI partnerships.

Should the world be facing a major recession, pharmaceutical companies are amongst the industries typically affected least by the situation. The key to the industry’s insulation against recession lies in the necessity of its products. In previous recessions, such as those in the early 90s, early 2000s and the global crash of 2008-09, US national healthcare expenditure rose as a share of GDP, with medical spending remaining stable.

Moreover, the pharmaceutical industry is determined to progress steadily through the fourth industrial revolution, not by choice, but by necessity. The introduction of new technologies and business models that strengthen the industry financially and structurally are critical for survival and competitiveness. Hence, partnerships between pharmaceutical manufacturers and AI drug developers are handled with the highest priority. A more efficient AI mediated drug development process with built-in risk-sharing properties gives a strong incentive to collaborate despite short to mid-term macroeconomic challenges.

Several industry announcements and developments during the first half of 2022 give confidence in the continued progress:

Big Pharma:

- Pfizer reported an 82% operational growth in revenues to $25.7 billion in the first quarter of 2022 as against $14.5 billion in the first quarter last year.

- GSK reported turnover of £9.8 billion for the first quarter of 2022 compared to £7.4 billion in the same quarter last year, and a growth of 40% to £7.1 billion in their biopharma business.

- Johnson & Johnson reported a second quarter 2022 adjusted operational sales growth of 12.4% to $13.3 billion in their worldwide pharmaceutical segment.

AI Industry:

- AbCellera reported 2021 total revenue of $375 million including $335 million in milestones and royalties, compared to a total revenue of $233 million in 2020. In addition, they reported first quarter 2022 revenue of $317 million, compared to $203 million in the same quarter last year.

- Adagene reported 2021 total revenue of $10.2 million compared to $0.7 million in 2020, and announced a new collaboration and exclusive license agreement with Sanofi, resulting in upfront payment of $17.5 million and potential milestone payments of up to $2.5 billion plus royalties on global net sales.

- Datavant announced new partnerships with Arcadia Partners, Komodo Health and PathAI.

- Exscientia reported 2021 full year revenue of $37 million compared to $13.1 million in 2020. First quarter 2022 results were $5.6 million compared to $5.3 for the first quarter last year. A $100 million upfront payment from a Sanofi collaboration signed in January 2022 should be reflected in cash flows for the second quarter of 2022.

- Gritstone Oncology reported 2021 full year revenue of $46.7 million, compared to $3.5 million for the prior year.

- Schrödinger reported full year 2021 financial results with a total revenue of $137.9 million, and first quarter 2022 revenue of $48.7 million.

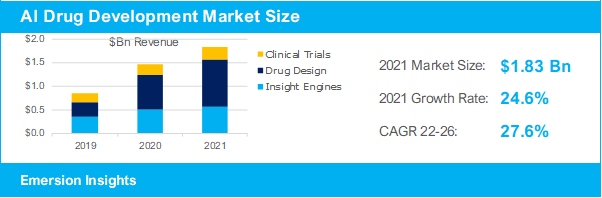

Overall, the global AI drug development market grew 24.6% in 2021, resulting in a market size of $1.83 billion. Although this is slightly lower than earlier projected, given the disruptions that challenged the industry last year, this is still a very impressive growth rate for an industry with such technological complexity.

What To Expect in the Second Half of 2022?

Over the coming weeks, company financials for the second quarter will be announced from the world’s largest corporations. This will give clear indications on the actual impact of the macroeconomic downturn and provide business projections for the full year 2022. Although most analysts have downgraded their expectations for S&P 500 annual performance, the consensus is still an increase in the second half of 2022. The rocky period is probably not over, and we are yet to see the effect of the interventions from the European Central Bank and the Federal Reserve, but the world economy is expected to pick up towards the end of the year.

As growth resumes in the global economy, we expect investments in AI drug development and clinical trials to pick up significantly as well. However, the current climate has prompted new demands for start-ups seeking capital. To instil investor confidence, start-ups need to demonstrate the ability to maintain base-level cashflow irrespective of Covid restrictions or a prolonged macroeconomic down-turn. There are several steps start-ups should take to achieve this:

- Base a larger proportion of revenue on long-term software subscriptions, as opposed to one-off projects and milestone-dependent partnerships.

- Demonstrate progression of projects despite Covid restrictions with trials that are less prone to disruption such as oncology and infectious disease trials.

- Increase chance of survival during a recession if R&D spending and early-stage funding should be cut or re-focused, by increasing the number of projects in drug repurposing and low-cost generic and biosimilar medicines.

- Prove how the AI solution can increase the success rate while reducing cost and risk, to support the pharmaceutical industry’s progression towards industry 4.0.

Although the use of artificial intelligence in drug development is still at a very early stage, its status as a future cornerstone in the pharmaceutical industry is already widely accepted. The AI industry is experiencing strong consolidation in terms of investments, but successful vendors are already establishing tight partnership networks and revenue-generating projects. In the coming years, many of these partnerships will come to fruition and bring milestone payments and royalties to the industry, as it will continue its journey towards a $6.2 billion market size in 2026.

More Research Available

Emersion Insights specialise in strategic market intelligence for investors and entrepreneurs. Our “AI in Drug Development Market Report” includes detailed investment analysis, market sizing, forecasting and strategic insights to help entrepreneurs and investors navigate in this fast-moving industry. Reach out to Founder & Principal Analyst Dr Ulrik Kristensen for more information: hello@emersioninsights.io