Royalties on sales are by no means new in AI drug development, but as the industry matures this component of the deals will play a bigger role and drive new market dynamics throughout the pharmaceutical industry. In this analyst insight, we will discuss diversification of revenue streams in the context of the wider pharmaceutical industry and relate this to the development stage of the individual AI startup.

The Evolution of The Deal Composition

Developing the right sales models for AI drug developers has always been a challenge. A typical SaaS license fee model has proven unsuitable, as it doesn’t adequately capture and reflect the potential value for the client. On the other hand, individual one-off consulting fees lack the risk-sharing component necessary for high-risk projects with long timelines for measuring success. This has created a complex and ever evolving deal composition.

Although the dominant sales model now is a partnership model with initial payment and milestone payments dependent on the success of the molecule in clinical development, there is no one-size-fits-all. Deals are highly dependent on the specific project, the client, the financial situation of the AI specialist, and the trust in a successful outcome from both the clients and the AI specialists perspective.

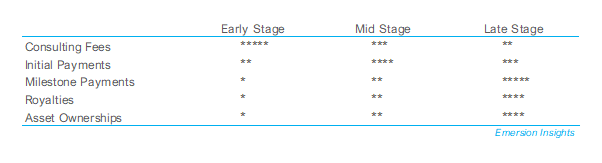

For the early-stage AI drug development startup, the first paid deals are typically one-off projects on a consultative basis, as some income helps convince investors that the algorithm works and there is business potential. These initial deals are typically with small and midsize pharma and biotech companies, and the deal sizes equally modest. As the company grows, partnership deals are typically initiated, and initial payments gradually develop into milestone payments for successful projects.

Once the AI specialist has proven successful in the first few partnerships, the opportunities for larger deals with leading pharmaceutical companies are chased. However, although the size of these big pharma partnerships are making headlines in the media, the proportions of the initial payments are often small compared to the total value of the deals. As the AI startup matures, the need to take on further risks increases considerably, as the majority of the revenue becomes success-dependent milestone payments.

The Longer You Wait, The More You Get… Probably

Sales royalties and asset ownership offer yet another income source for AI specialist with the financial backup to engage in long-term deals with considerable risk.

To obtain asset ownership in larger deals with pharma is notoriously hard, but royalties on pharmaceutical sales are becoming a crucial component in larger partnership deals. For the pharmaceutical company, these royalties decrease the risk even further and delay a proportion of the expenses until an actual revenue is generated from pharmaceutical sales. Many pharmaceutical companies are therefore willing pay considerable money for such de-risking deal structures.

For the AI specialist with financial backup to engage in long-term deals, the reward can be significant. However, skills in providing a precise evaluation of future sales in highly competitive and changing markets is required, as is securing sufficient financial backup and cashflow in the extended period from deal to payment. Getting the right balance between short, mid and long-term revenue, aligned with the startups stage in development, is therefore essential.

Putting too much emphasis on asset ownership and royalties early in business development, can cause an unhealthy balance line and a dependence on investors without convincing financial mastery; a situation that can turn fatal for any company. On the other hand, asset ownerships and sales royalties can also drive bigger funding rounds, as the prospects of considerable future income attracts long-term investors in the industry. Preparing early for diversified revenue streams is therefore important.

What This Means For The AI Ecosystem

With more than $9.2B total investment in the industry and numerous big pharma partnerships established in recent years, many AI specialists are now prepared to take on additional risk in return for potentially highly rewarding royalty deals.

Turning the risk-lever further towards the AI specialist with more emphasis on royalties, will drive more deals with small and mid-sized pharmaceutical companies and early stage biotech companies. The prospects of benefitting from AI partnerships in return for sales royalties with delayed payments, will attract clients with tighter budgets and funding-dependence, as the typical clinical milestones would offer no immediate income.

On the longer term, royalties on sales will increase the potential market size for AI in drug development, as a larger proportion of the revenue will be from outside the pharmaceutical R&D expenditure and clinical development accounts. This will help drive larger funding rounds in the industry in the shorter term, especially for vendors with a healthy mixture of diversified revenue streams.

The ability to seek royalty deals requires sufficient financial backup for the AI specialist. Royalty deals will therefore favour more established vendors able to take higher risks, and consequently fuel further consolidation in this highly fragmented industry.

More Research Available

Emersion Insights specialise in strategic market intelligence for investors and entrepreneurs. Our market report “AI in Drug Development” includes detailed investment analysis, market sizing, forecasting and strategic insights to help entrepreneurs navigate in this fast-moving industry. Reach out to Founder & Principal Analyst Dr Ulrik Kristensen for more information: hello@emersioninsights.io