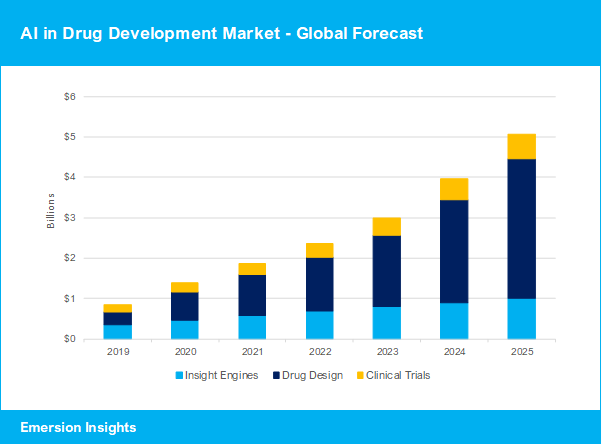

The world market for AI applications in drug development is projected to reach $5.1 billion by 2025 with a CAGR of 29.6%, an increase of over $3.6 billion from the market size in 2020. However, significant challenges are lurking ahead as the industry enters the next phase.

During the COVID-19 pandemic there have been several positive developments for the AI drug development market. These include large funding rounds, an up-tick in acquisitions & IPO’s and huge milestone deals that have matured and resulted in sizeable payouts.

In terms of revenue growth, the AI drug design industry contributed massively to the increase in 2020. Milestones and royalties in the AI drug design industry gave clear indications of what we can expect in the future. While the overall AI drug development market grew 61.1% in 2020, AI drug designers enjoyed a staggering 130.1% growth.

Emersion Insights has categorised the AI drug development industry into Insight Engines, Drug Design and Clinical Trials:

Insight Engines are artificial intelligence platforms that aggregate and analyse information and real-world evidence from multiple sources such as scientific literature, patient data and clinical trial information to find new associations and guide drug discovery or clinical trial optimisation. Some of the Insight Engine vendors funded this year include Aetion, Cellarity, Causaly and Elucidata.

Drug Design applications are using AI to develop new molecules, predict and optimise drug specificity and efficacy or select drug repurposing options for existing drugs. Some of the Drug Design vendors funded this year include Insitro, Exscientia and Insilico Medicine.

Clinical Trial applications help optimise the clinical trial process by improving patient stratification with finer nuances to get the right patients for the right trials, optimise enrolment and retention, and in some cases help reduce the number of patients needed for a successful trial. Some of the Clinical Trial vendors funded this year include Medable, Mendel.ai and Novadiscovery.

Looking ahead, we expect AI drug design to continue playing a major role in this market’s growth. While insight engines and clinical trial solutions offer more predictability in income, successful AI drug designers have the potential to reach astonishing milestone payments and royalties. This has attracted a high number of risk tolerant investors; 57% of the total investment in the industry has gone to AI drug designers. However, the potential reward comes with significant risk. With more than 130 AI drug designers to choose from, investors need to tread carefully in this industry.

Big pharma will continue to drive considerable growth in the years to come. While insight engines and clinical trial specialists will see continued revenue growth in the academic and healthcare segments as the need for higher efficiency and decentralisation in clinical trials continues, milestone payments from big pharma to AI drug designers will remain a central contributor to the growth.

Challenges Lurking Ahead

However, under the polished surface of revenue growth and massive funding, this industry is going to experience significant challenges in the coming years:

- A strong consolidation of the investments in the industry means a few front runners now receive larger proportions of the overall funding, while late entrants struggle to keep up.

- The trend towards R&D outsourcing in big pharma has intensified in recent years, which means big pharma may be less keen on acquiring AI specialists than expected.

- For many of the pharmaceutical companies prioritising internal R&D capabilities, interoperability challenges, siloed data and ongoing quantum computing readiness programs still need attention, before being able to reach the full potential of AI acquisitions.

- After years of focusing on developing solutions and establishing initial partnerships, the competition amongst AI specialists has started to be reflected in revenue. Large milestone payments now differentiate the players and further amplify the industry consolidation.

The largest and most successful AI firms are going for a long-term CRO strategy supporting the pharmaceutical industry as a separate entity. They have no intention of being acquired by their pharma partners. However, for many of the smaller players with strong solutions but less progression business development wise, the best choice may often be to stay ahead of the inevitable consolidation and be acquired by these larger AI firms as they expand their capabilities.

As the industry enters the next phase, AI leaders are fine tuning their strategic machinery. Many start-ups will fail, some will be acquired, and a few will grow to become highly profitable AI drug discovery CRO’s to the global pharmaceutical industry. And it’s a prize worth the effort. These firms will tap into a $200 billion annual pharmaceutical R&D budget.

More Research Available

Emersion Insights specialise in strategic market intelligence for investors and entrepreneurs. Our AI in Drug Development market report includes detailed investment analysis, market sizing, forecasting and strategic insights to help entrepreneurs and investors navigate in this fast-moving industry. Reach out to Founder & Principal Analyst Dr Ulrik Kristensen for more information: hello@emersioninsights.io